Downsizing for Retirement in Northern Colorado Springs

🧓 Does Your Current Home Still Fit Your Retirement Plans?

A Local Look at What Retirees Are Doing in Northern Colorado Springs

Here in 80921, 80908, and 80132, we’re seeing a growing number of homeowners either in retirement or approaching it within the next 10 years reassessing whether their current home still fits the life they want next.

Over the past 24 months, the majority of our sellers have been:

-

Retirees relocating to warmer climates (like Arizona or Florida)

-

Empty nesters looking to downsize or simplify

-

Local investors reducing their real estate portfolio

-

Longtime homeowners seeking to move closer to family

Whether motivated by lifestyle, budget, or proximity to loved ones, one question often comes up:

“Does staying in this home still make sense for the next chapter of my life?”

🔍 What Downsizing Looks Like Here

There’s no single “retirement community” in our area, but downsizing trends are clear:

-

Patio homes and ranch-style floor plans are in high demand

-

In 80921, the Village of Siena in Flying Horse stands out. The HOA handles exterior maintenance, offering a low-maintenance, resort-style lifestyle that snowbirds and retirees especially appreciate.

-

Buyers often seek homes close to golf courses, pickleball courts, medical care, restaurants, and shopping, aiming to reduce driving and boost convenience

💵 Financial Pressures on Fixed Incomes

Retirees are increasingly voicing concern over:

-

📈 Rising property taxes, driven by high home values

-

🔥 Spiking insurance premiums, especially given our wildfire risk and the windy Palmer Divide

-

🧾 Utility costs and home maintenance that don’t always align with a fixed or semi-fixed income

That’s why many clients are prioritizing efficiency and simplicity over square footage.

While some do take advantage of their equity to buy a smaller home in cash or with a significantly lower mortgage, we find that money is usually a secondary motivator. More often, it’s about:

-

🌤️ Getting to a more temperate climate

-

👨👩👧 Being closer to kids and grandkids

-

🏠 Moving into a home that requires less physical effort or financial upkeep

👥 How We Help Retirees Decide What’s Next

We believe your home should support your lifestyle, not hold it back. That’s why we ask every retiree or near-retirement homeowner:

“What do you want your next chapter to look like—and does your home help make that possible?”

We don’t offer financial or estate advice ourselves—but one of our brokers is a Seniors Real Estate Specialist® (SRES®). That means we’re trained to:

-

Understand the specific needs of seniors

-

Provide personalized guidance on downsizing, selling, or relocating

-

Tap into a network of senior-focused professionals, including estate planners, financial advisors, and senior living specialists

If you’re considering a move—or even just starting to think about what’s next—let’s talk. Whether your timeline is six months or six years out, we’re here to help you create a plan that aligns with your goals and your lifestyle.

📰 What Do the National Trends Say?

For added perspective, here’s what the team at Keeping Current Matters shared this week about how inflation, retirement goals, and real estate decisions intersect across the country:

Does Your Current Home Fit Your Retirement Plans?

Retirement isn’t just a milestone. It's the beginning of something really special. After years of hard work, it’s finally time to slow down, explore new passions, and live life on your own terms.

But with this exciting chapter comes some big choices. And one of the biggest is this: does your current home still make sense for the lifestyle (and budget) you want in this next phase of life?

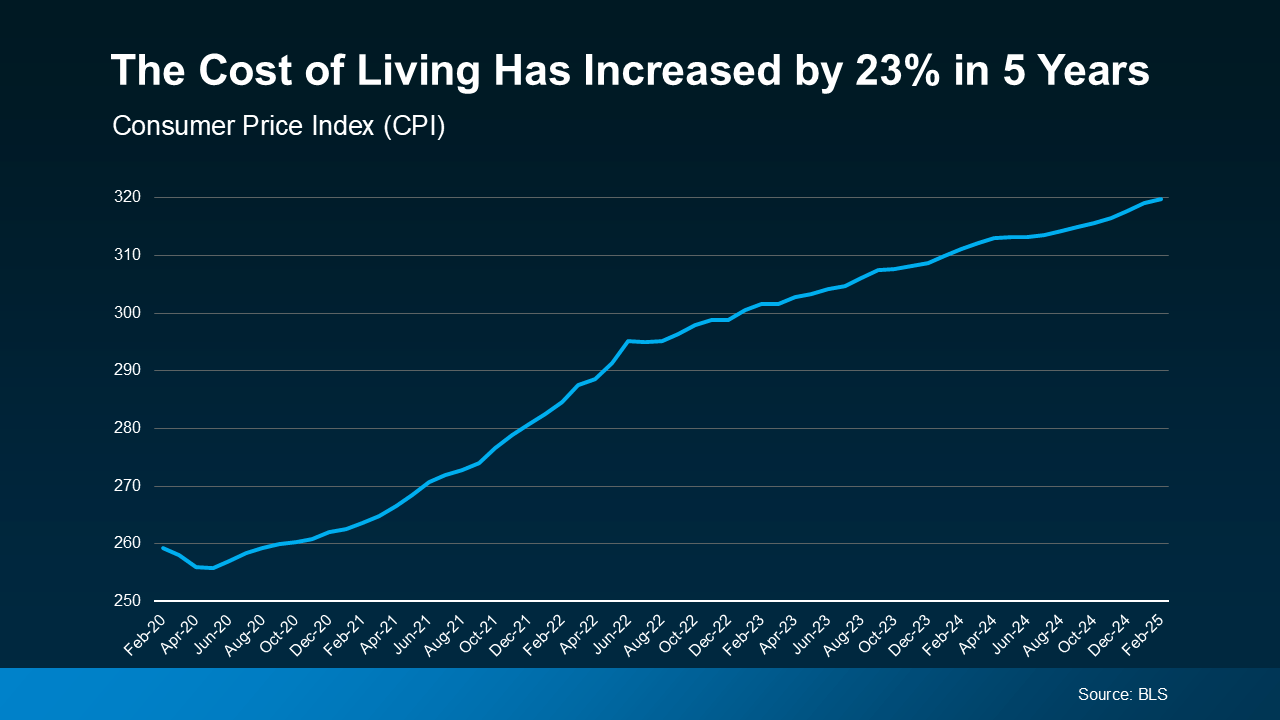

That’s an especially important question right now. Just in the past five years, the cost of living has jumped by 23% according to the Bureau of Labor Statistics (BLS). That’s based on the Consumer Price Index (CPI), which is how changes are tracked in the average price consumers pay for goods and services (see graph below):

When you’re thinking about how to make your retirement savings last, those rising expenses matter. And if you’ve started to wonder whether your money will stretch as far as you need it to go, don’t worry. You may have more control than you think.

When you’re thinking about how to make your retirement savings last, those rising expenses matter. And if you’ve started to wonder whether your money will stretch as far as you need it to go, don’t worry. You may have more control than you think.

One way many retirees are protecting their savings is by relocating. Because your dollars do go further in some places.

Moving to an area with a lower cost of living can help you save on regular expenses like your housing, utilities, and taxes – especially if you downsize at the same time.

And that can free up room in your budget for the things that make retirement some of the best years of your life: travel, hobbies, spoiling your grandkids, or any of the other things you’ve been dreaming about doing in this next phase.

That’s not to say you have to move. It just means you’ll want to think about where you plan to live and make sure you’ve got enough savings to cover actually living there. It's all about planning. As Go Banking Rates explains:

“How much you should have saved for retirement depends on a few key factors, including your location. Where you choose to spend your golden years is critical.”

And you don’t always have to go far. Sometimes it’s out of state, but other times moving to the suburbs instead of living near the city can make a big difference. And that’s worth thinking about as you plan for your next chapter.

Whether you’re considering downsizing, moving closer to your grandkids, or heading to an area where you can stretch your savings, a real estate agent can help. They’ll work with you to explore the options that make sense for your goals – and can help make selling your current house easier. They can also connect you with trusted agents in other parts of the country if you're considering a big move.

Bottom Line

You’ve worked hard to build a future you can enjoy. If your current home or location no longer supports that, it may be time to explore what’s next.

What does your ideal retirement look like? And could a move help make it even better? Let’s talk about how to make that vision a reality.